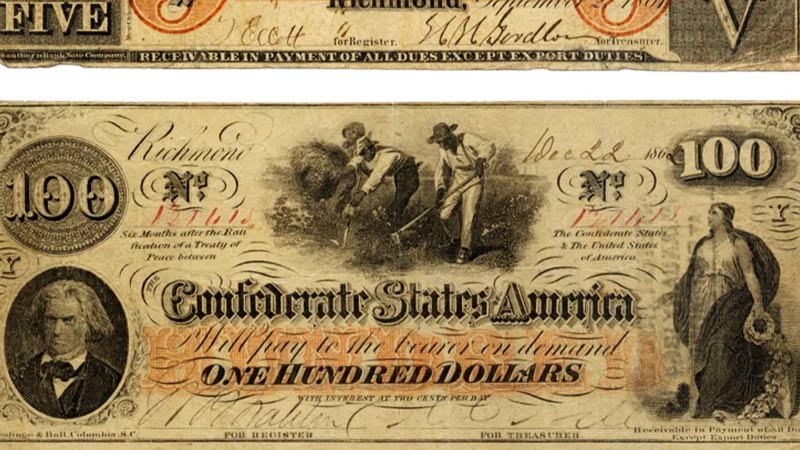

Confederate Debt Repudiation, a critical facet of post-Civil War American history, refers to the deliberate rejection of financial obligations by the Confederate States of America.

In the aftermath of the Civil War (1861-1865), the U.S. government mandated Confederate states to disavow the debts incurred during the conflict.

This act of repudiation was grounded in allegations of improper fund utilization and the dishonest financial practices of the Confederate government.

The rejection of state debts unfolded against a backdrop of significant financial burdens, with individual states defaulting on payments.

The ensuing crisis, entangled with political maneuvering, led to legislative interventions, highlighting the intricate interplay of economic challenges and post-war political dynamics.

What Does Repudiation of Confederate Debt Mean?

Confederate debt repudiation refers to the act of rejecting or refusing to honor the debt obligations incurred by the Confederate States of America during the American Civil War (1861-1865).

After the war, the U.S. government required the Confederate States to repudiate the debts they had contracted.

The justifications for repudiation were improper use of the borrowed funds and the dishonesty of the Confederate government.

Key points about Confederate debt repudiation include:

Significant Debt Burden

The burden of debt carried by the Confederate states was profound. Individual states found themselves grappling with substantial amounts in warrants and treasury notes.

For example, Texas faced a staggering total war debt of $8,000,000, while Georgia’s debt exceeded an even more daunting $18,000,000.

This underscored the magnitude of the financial challenges that emerged in the wake of the Civil War.

Defaulting and Repudiation

The onset of the repudiation crisis can be traced back to the 1860s when states began defaulting on interest payments. This marked the beginning of the repudiation of state debts.

Despite the generally positive credit ratings of most Southern states, certain states, such as Florida and Mississippi, engaged in repudiation with seemingly less justification.

The defaulting on interest payments added layers of complexity to the financial fallout.

Political Crisis

The repudiation crisis evolved beyond a financial quagmire; it became a deeply entrenched political issue.

Both the Republican and Democratic Parties strategically exploited concerns over public debt, using them as potent political tools to advance their respective agendas.

The Civil War debt crisis, thus, consisted of a trio of interconnected crises: repudiation, repayment, and refunding.

The entanglement of financial and political considerations added a layer of complexity to the resolution of the post-war financial challenges.

Constitutional Amendment

In response to the repudiation crisis, the U.S. government took legislative action. A constitutional amendment was enacted to explicitly assert the “validity of the public debt of the United States.”

This constitutional safeguard aimed to secure the repayment of debts and preempt any future instances of repudiation.

It represented a clear commitment by the federal government to uphold its financial obligations and maintain the integrity of public debt in the aftermath of the Civil War.

What Does It Mean to Repudiate a Debt?

Repudiating a debt is a decisive action wherein a debtor consciously chooses to reject or ignore the financial obligations outlined in a debt agreement.

This act can take various forms, each reflecting a refusal to adhere to the terms of the debt arrangement.

Refusal to Pay

The most straightforward manifestation of debt repudiation involves a refusal to make agreed-upon payments.

This can encompass missing scheduled payments, intentionally defaulting on loans, or expressing a clear intention to cease all payments.

This form of repudiation directly contravenes the contractual commitment to meet financial obligations.

Disputing the Legitimacy

Beyond non-payment, debt repudiation may involve challenging the legitimacy of the debt itself.

Debtors may claim that the debt is invalid due to factors such as fraud, misrepresentation, or violations of consumer protection laws.

Disputing the legitimacy is a legal strategy aimed at absolving the debtor of their financial responsibilities.

Renunciation of Obligations

Repudiation can extend beyond mere non-payment to include a broader renunciation of obligations specified in the debt contract.

Debtors may refuse to adhere to covenants, terms, or conditions stipulated in the agreement, further complicating the resolution of the debt issue.

Public Declaration

In some cases, debt repudiation is accompanied by a public declaration or announcement.

This public acknowledgment communicates the debtor’s explicit decision not to comply with the terms of the debt arrangement.

Such declarations can have repercussions not only in legal and financial circles but also in public perception.

Legal Ramifications

Debt repudiation often triggers legal consequences. Creditors may pursue legal action to enforce the debt agreement, seeking repayment through court proceedings or other legal means.

Conversely, debtors may employ legal defenses or counterclaims to justify their repudiation, engaging in a legal battle to resolve the dispute.

Impact on Creditworthiness

One of the significant repercussions of debt repudiation is its impact on creditworthiness.

Failing to fulfill financial obligations damages the debtor’s credit score, making it more challenging to secure future loans or credit.

This diminished creditworthiness can have lasting effects on the individual or entity’s financial standing.

Economic and Financial Implications

On a broader scale, widespread or systemic debt repudiation can have economic repercussions.

If a significant number of debtors repudiate their obligations, it can erode trust in financial systems, disrupt markets, and impact the stability of lending institutions. This can contribute to economic uncertainty and financial instability.

What Is Repudiation of National Debt?

The repudiation of national debt refers to a government’s formal refusal or rejection to honor the financial obligations incurred through national borrowing.

This significant action is characterized by a deliberate decision by a sovereign nation to default on its debt payments or, in extreme cases, to disclaim the legitimacy of the debt itself.

The repudiation of national debt has profound implications, affecting not only the economic stability of the country but also its standing in the international financial community.

Key aspects of repudiation of national debt include:

Sovereign Decision

The repudiation of the national debt is a sovereign decision, highlighting the government’s conscious choice to either default on its debt payments or reject the legitimacy of the debt altogether.

This decision is often driven by a combination of economic challenges, fiscal mismanagement, and political considerations.

Economic Consequences

The economic fallout from repudiating national debt is profound. It can lead to a downgrade in the country’s credit rating, making it more difficult and expensive to secure future loans.

Investors may lose confidence, resulting in capital flight, currency devaluation, and economic turmoil.

The ripple effects of economic distress are often felt by the general population through rising unemployment and inflation.

Impact on International Relations

The repudiation of national debt strains international relations as creditors, including foreign governments and financial institutions, may respond with legal action or diplomatic measures.

This can lead to a breakdown in trust and cooperation between the defaulting nation and its creditors, potentially impacting trade agreements and diplomatic ties.

Legal Ramifications

The legal consequences of debt repudiation hinge on the terms of the debt agreements.

Creditors may pursue legal action through international courts, seeking to recover their investments.

Legal battles can exacerbate the economic challenges faced by the defaulting nation and further strain its resources.

Social and Political Fallout

The repudiation of national debt often triggers social and political upheaval. Austerity measures, necessary to stabilize the economy, can result in public discontent and protests.

Political leaders may face challenges to their legitimacy as citizens grapple with the consequences of economic hardship.

Historic Instances

Throughout history, some nations have resorted to repudiating their national debt as a response to dire economic circumstances.

A notable example is Argentina in the early 2000s, where a large-scale default contributed to a prolonged economic crisis and social unrest.

Alternatives and Negotiation

In some cases, nations facing unsustainable debt burdens explore alternatives before resorting to repudiation.

This may involve negotiating with creditors to restructure debt or modify repayment terms.

Seeking assistance from international financial institutions can also be considered as an alternative to outright default.

Last Resort Measure

Repudiation of the national debt is generally considered a last-resort measure due to its severe and far-reaching consequences.

Governments exhaust other avenues, such as economic reforms and negotiations, before opting for such a drastic step.

The decision to repudiate is often indicative of a financial crisis reaching a critical juncture.

What Happened to the Confederacy’s Debt?

Following the American Civil War, the fate of the Confederate States of America’s debt became a complex and contentious chapter in post-war American history.

The Confederate government, having faced defeat, grappled with significant financial challenges, and the resolution of their debt involved a multifaceted process combining repudiation, negotiations, and legislative actions.

Repudiation by the Confederate States

In the aftermath of the war, the U.S. government mandated the Confederate States to repudiate the debts they had incurred during the conflict.

This directive was rooted in the belief that the Confederate government had engaged in improper use of borrowed funds and had been dishonest in its financial practices.

State-Level Repudiation

At the state level, individual Confederate states confronted the daunting task of addressing the substantial debt they had amassed.

Some states defaulted on interest payments, while others took the more extreme step of outright repudiation.

Motivations for repudiation varied, encompassing financial hardship, political considerations, and disputes over the legitimacy of the debt itself.

Post-War Economic Challenges

The Southern states faced formidable economic challenges in the post-war era.

The devastation wrought by the war, coupled with the emancipation of slaves and the collapse of the Confederate economy, created a difficult economic environment. These challenges complicated efforts to address the outstanding debt issue.

Reconstruction Period

The post-war era, known as the Reconstruction period (1865-1877), saw efforts by the U.S. government to reintegrate Southern states into the Union and address the economic aftermath of the war.

The question of Confederate debt was intricately linked with broader issues of rebuilding the Southern economy and establishing political stability.

Amendments and Legislation

To navigate the repudiation crisis and stabilize the post-war financial landscape, the U.S. government implemented legislative measures.

The 14th Amendment, ratified in 1868, included a section explicitly affirming the “validity of the public debt of the United States.”

This constitutional provision implicitly addressed concerns related to the Confederate debt and sought to provide a foundation for financial stability.

Debt Refunding and Settlement

Over time, concerted efforts were made to refund and settle outstanding debts. Negotiations between the federal government and individual states aimed to find equitable solutions to the complex financial issues arising from the war.

These negotiations often involved compromises and agreements on debt repayment terms.

Long-Term Impact

The repudiation of Confederate debt had enduring consequences for the Southern states. It adversely affected their creditworthiness and impaired their ability to secure financing for post-war reconstruction and development.

The economic scars resulting from both the war and debt repudiation lingered for years, influencing the trajectory of Southern economies.

FAQs

Why did the Confederate States repudiate their debts?

The repudiation of Confederate debts was driven by the U.S. government’s belief in the improper use of borrowed funds and dishonest financial practices by the Confederate government.

The rejection was part of post-war measures to address the financial aftermath of the conflict.

What were the economic consequences of Confederate Debt Repudiation?

Confederate Debt Repudiation had profound economic consequences, affecting the creditworthiness of Southern states.

It led to financial challenges, defaults on interest payments, and impacted the overall stability of the post-Civil War Southern economy.

How did the political landscape contribute to Confederate Debt Repudiation?

The repudiation crisis was not just financial; it was intricately linked to the political landscape.

Both the Republican and Democratic Parties exploited concerns over public debt for political gains, turning the crisis into a multifaceted issue with repudiation, repayment, and refunding crises.

What legislative measures were taken to address Confederate Debt Repudiation?

To address the repudiation crisis, the U.S. government passed a constitutional amendment ensuring the “validity of the public debt of the United States.”

To Recap

Confederate Debt Repudiation stands as a pivotal chapter in the aftermath of the American Civil War, marking the deliberate rejection of financial obligations by the Confederate States of America.

Fueled by allegations of fiscal impropriety and dishonest practices, the repudiation unfolded amidst a complex web of economic challenges and political maneuvering.

The rejection of state debts, coupled with defaults and subsequent legislative interventions, showcased the intricate interplay between financial stability and post-war political dynamics.

As a lasting imprint on American history, Confederate Debt Repudiation not only shaped the economic destinies of the Southern states but also underscored the enduring impact of wartime financial decisions on the nation’s trajectory.

Leave a Reply